Resource Center

Are There TCPA Exemptions for Financial Institutions?

Type: Blog

Topic: Do Not Call Solution

Yes, TCPA exemptions do apply to financial institutions, but they are limited and highly specific. Under the Telephone Consumer Protection Act (TCPA), financial institutions are allowed certain types of communications without obtaining prior express consent. These exemptions include calls or texts for fraud alerts and identity theft notifications, data breach notifications, and transaction/account-related alerts (e.g., overdraft warnings). However, marketing or solicitation communications are not exempt and require prior express written consent. Strict compliance is required to avoid costly penalties.

While exemptions provide some leeway, navigating TCPA rules remains complex. This is where PossibleNOW’s DNCSolution® comes in. By managing your do-not-call compliance and TCPA requirements, DNCSolution offers financial institutions a reliable, enterprise-ready platform to reduce risks and streamline compliance efforts across communication channels.

Speak With an Expert Today

TCPA Exemptions That Apply to Financial Institutions

The Federal Communications Commission (FCC) has issued exemptions for financial institutions related to urgent, time-sensitive communications, such as:

- Fraud Alerts & Identity Theft Notifications – Calls or texts to inform customers about potential fraud or unauthorized transactions on their accounts.

- Data Breach Notifications – Alerts regarding a security breach that may affect a customer’s personal financial information.

- Transaction & Account Notifications – Communications related to post-transaction updates, such as overdraft warnings or declined transaction alerts.

Conditions for Exemption

To qualify for these exemptions, financial institutions must:

- Be free of charge (customers must not be charged for the call or text).

- Be sent only to the number provided by the customer.

- Provide a clear way to opt out.

- Be limited in frequency (e.g., no more than three messages per event over a three-day period).

It’s important to note that these exemptions only apply when communications are purely informational. If there is any promotional content or sales messaging, TCPA consent requirements still apply.

Non-Exempt Communications

Financial institutions are not exempt for:

- Marketing or promotional messages (e.g., loan offers, credit card promotions).

- Debt collection calls (except in certain cases where prior express consent exists).

- General customer service messages (that are not time-sensitive).

Common TCPA Compliance Challenges for Financial Institutions

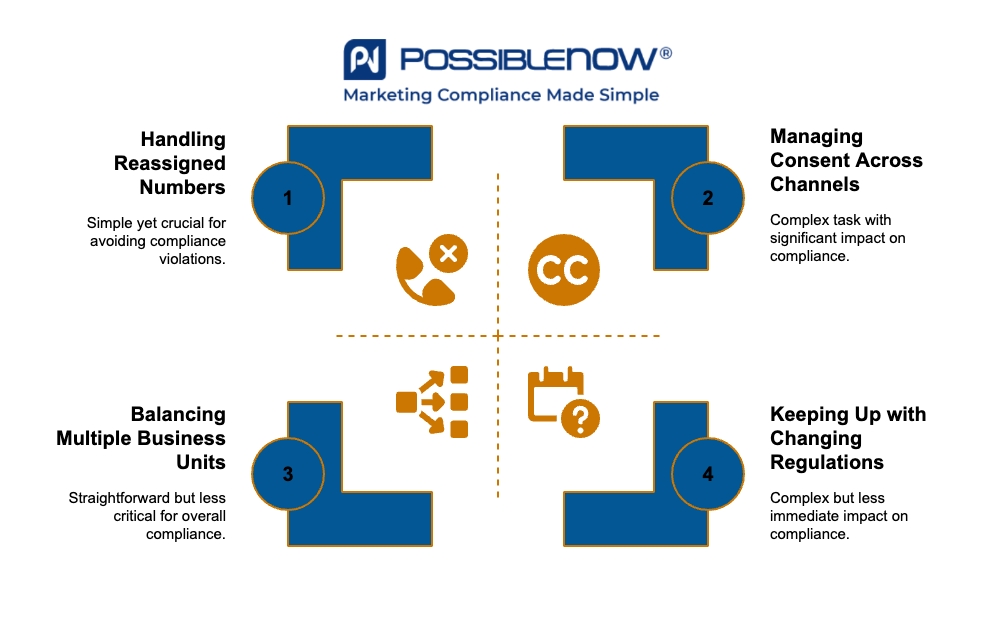

Financial institutions face unique compliance hurdles, such as:

- Managing Consent Across Channels: Obtaining, tracking, and maintaining customer consent for calls, texts, and emails across multiple touchpoints and systems.

- Handling Reassigned Numbers: If a phone number changes ownership, calling it without updated consent can lead to violations. Tools like the Reassigned Number Database mitigate this risk.

- Balancing Multiple Business Units: Large financial organizations must consolidate customer preferences and consent across divisions to remain compliant.

- Keeping Up with Changing Regulations: TCPA rules evolve frequently, making it challenging to maintain a consistent compliance strategy without expert support.

Financial Consequences of TCPA Non-Compliance

TCPA violations carry steep penalties that can quickly escalate. Financial institutions face:

Fines of up to $1,500 per violation

Each unsolicited call, text, or message can result in a hefty fine.

Class Action Lawsuits

Non-compliance often leads to costly litigation, with average settlements exceeding $6 million.

Reputational Damage

Violating consumer trust can erode long-term relationships and brand credibility.

Best Practices for Financial Institutions to Mitigate TCPA Risk

- Centralize Consent Management: Use an enterprise-level solution like DNCSolution to manage and verify customer opt-ins and preferences in real time.

- Regularly Scrub Contact Lists: Maintain updated, compliant contact lists by scrubbing against federal and state do-not-call registries and the Reassigned Numbers Database.

- Collect Express Written Consent: Obtain clear, documented consent for any marketing communications, especially for text or automated calls.

- Implement Ongoing Monitoring: Continuously audit and monitor TCPA processes to stay ahead of regulatory changes.

- Educate Your Teams: Provide training on TCPA requirements and internal compliance policies to minimize human error.

PossibleNOW’s DNCSolution® simplifies compliance management with its robust features, helping financial institutions navigate TCPA exemptions, reduce risks, and focus on building meaningful customer relationships.

Request a Demo Today

About PossibleNOW

PossibleNOW is the pioneer and leader in customer consent, preference, and regulatory compliance solutions. We leverage our MyPreferences technology, processes, and services to enable relevant, trusted, and compliant customer interactions. Our platform empowers the collection, centralization, and distribution of customer communication consent and preferences across the

enterprise. DNCSolution addresses Do Not Contact regulations such as TCPA, CAN-SPAM and CASL, allowing companies to adhere to DNC requirements, backed by our 100% compliance guarantee.

PossibleNOW’s strategic consultants take a holistic approach, leveraging years of experience when creating strategic roadmaps, planning technology deployments, and designing customer interfaces. PossibleNOW is purpose-built to help large, complex organizations improve customer experiences and loyalty while mitigating compliance risk.

-

TCPA Regulations and Compliance: Complete Guide

Type: Blog

Topic: Do Not Call Solution

-

Defining Meaningful Metrics: 6 Soft KPIs to Measure Customer Preference Collection

Type: Blog

Topic: Preference Mgmt

-

Email Preference Center Best Practices

Type: Blog

Topic: Preference Mgmt

-

The Basics of DNC Scrubbing: What Is a Do Not Call (DNC) Scrubber and Why Do You Need It?

Type: Blog

Topic: Do Not Call Solution

-

What is Consent Management, How it Works, & Why it’s Important for Data Compliance

Type: Blog

Topic: Consent Mgmt

-

Do Insurance Companies Cover TCPA Damages?

Type: Blog

Topic: Do Not Call Solution

-

8 Best Practices for Capturing GDPR Consent

Type: Webinars

-

Data Silos Cause Communication Gaps

Type: Videos

Topic: Preference Mgmt

-

Difference Between Preferences & Consent

Type: Videos

Topic: Preference Mgmt

-

Integrate Do Not Call Compliance with Preferences

Type: Videos

Topic: Preference Mgmt

-

Customer Preferences Require More Than One Flavor

Type: Videos

Topic: Preference Mgmt

-

Give Customers Opt-Down Options

Type: Videos

Topic: Preference Mgmt

-

Preference Center Organization

Type: Videos

Topic: Preference Mgmt

-

Strategic Consultants Benefited Scotiabank

Type: Videos

Topic: Industry Testimonials

-

How to Check If a Number Is on the Do Not Call Registry

Type: Blog

Topic: Do Not Call Solution

-

Building a Customer-Centric DNC Strategy

Type: Blog

Topic: Do Not Call Solution

-

Best Tools for Managing Do Not Contact Lists

Type: Blog

Topic: Do Not Call Solution