Providing Powerful Results

60%

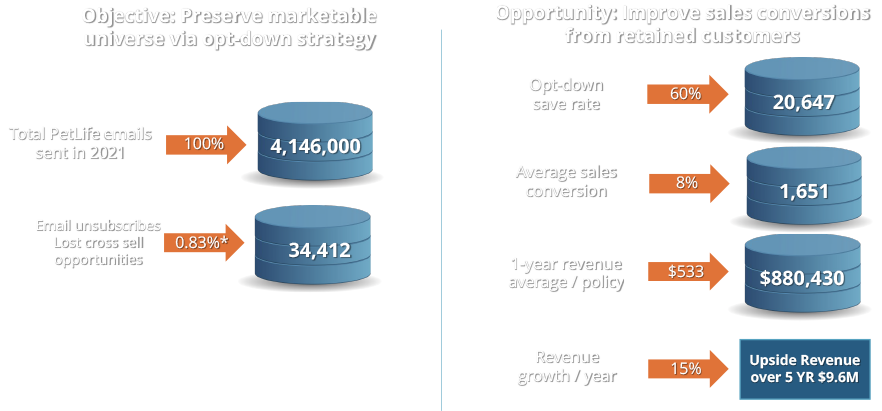

Global Opt-Out Saves

1,650

Additional Sales

$10M

Revenue Growth Over 5 Years

Challenge

Reduce Opt-Outs to Grow Revenue

Due to high opt-out rates, the bank was losing the opportunity to cross sell their existing customers. They had a critical need for a system that would track…

- Which customers fell under which business units

- Which products or services they purchased

- What their preferences and interests include

They needed the ability to share that information across the entire organization. Further, they needed to compile customer profiles in a preference center, enabling customers to tailor their customer communication preferences. By doing so, each business unit could maintain their own specific opt-in list, and thereby keep more customers within their marketable universe.

Bank Overview: As one of the largest financial institutions in the world, our client has a very complex organization. They have many business units, yet many customers never interact with more than three of the products and services they offer.

The financial institution’s core challenge was to reduce global opt-out rates due to non-relevant communications and engage customers with communications of interest.

Solution

Implement Opt-Down Strategy

PossibleNOW’s strategic consultants assessed the opt-out issue in detail, identifying specific problem areas and recommendations to mitigate their global opt-out rates.

By limiting an opt-out request to one specific product line or communication type, the company was able to retain a large percentage of contacts for other products or service engagements.

During our engagement, we advised our client on preference center design best practices and how to increase mobile app adoption, which increased consistency across the customer journey.

As a result, the financial institution increased customer engagement, retention, and increased cross sell opportunities for new products.

The Numbers

Utilizing a well-designed opt-down page saves 60% to 90% of global unsubscribes. Using a 60% estimate, the financial institutions pet insurance division was able to retain and continue marketing to an additional 20,600 customers. On average, they cross sell a pet insurance policy to 8% of those customers annually, with a revenue growth rate of 15% YoY. This renders almost $10M over five years.