TRUST

Insurance Relationships are Built on Trust

Utilizing zero-party data (such as customer preferences, consents, and insights) can enable your insurance organization to build customer trust and long-term relationships with your policy holders.

Customers use property and casualty insurance for a wide variety of policies, including renter’s insurance, personal articles policies, vehicles, and real estate. They need confidence in the carrier’s ability to deliver policy and claim information efficiently and to handle their personal data appropriately and safely.

ENHANCES

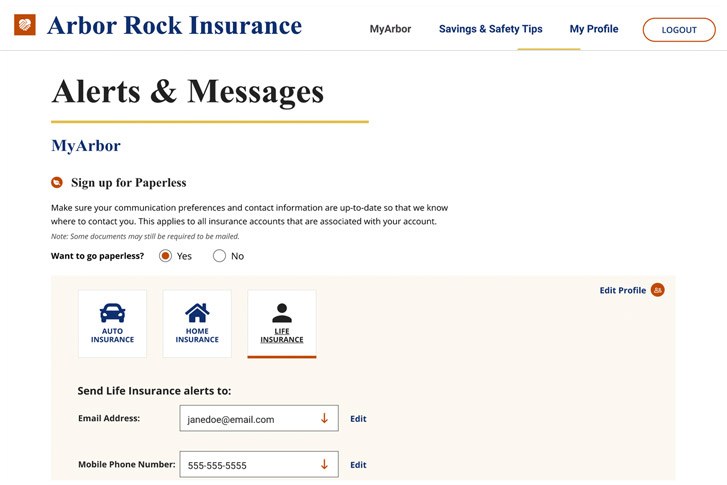

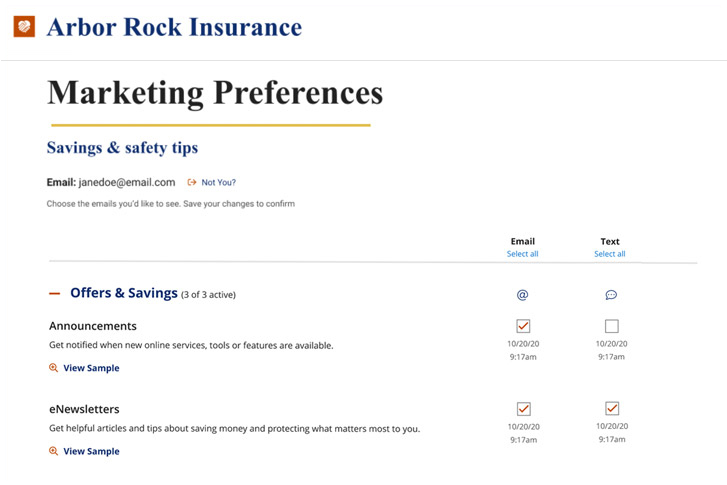

Trust Centers Provide Data Access to Policy Holders

In today’s rapidly evolving digital environment, customers in the property and casualty insurance market expect to access the information they seek at any time, over the channel they prefer.

Companies can set themselves apart by utilizing well-designed online trust centers for policy holders to add or amend their profile and other zero-party data, including their preferences and consents for communications. Trust centers provide a simplified user experience and can be used to increase paperless adoption. Electronic delivery helps the carrier reduce time and costs of sending out large packets of paperwork by mail – claims, policies, and terms of use, while increasing customer satisfaction.

ORGANIZATION

Share Zero-Party Data Organization Wide for Seamless CX

Enhance your organization’s ability to deliver seamless customer experiences at each stage of the customer journey using near real-time APIs.

Collecting and utilizing customer consents and preferences requires that data to be shared throughout your insurance organization, dynamically updating as policy holders provide or amend their zero-party data. Managing user data with an intelligent strategy enhances efficiency and communication from carrier to customer, especially at times that can already be stressful and confusing for your policy holders (such as navigating the claims process).

EXPERTS

Our Experts Can Help You

Our experts can help you develop a roadmap through the customer journey, using decades of property and casualty insurance industry best-practices and top level data management techniques to recommend solutions that will work for your unique organization and offer your policy holders personalized experiences. Our advanced platform integrations will connect and utilize your existing tech stack while maintaining compliance with privacy regulations, which future proofs your technology investment.