INDUSTRY

Financial Services

Leverage consent, preference, & insight data to enhance customer experiences and transform your financial services organization.

- Filomena Henriques, Scotiabank

TRUST

Financial Relationships Require Trust

Customers choose to bank and invest with institutions they trust. Building trust includes being transparent about how you collect and use customer data. Having the right zero-party data strategy will encourage customers to share their consents and preferences with both customer service and during digital interactions.

Scotiabank Benefits from Compliance, Insights, and Self-Service

WATCH TESTIMONIAL

INTERESTS

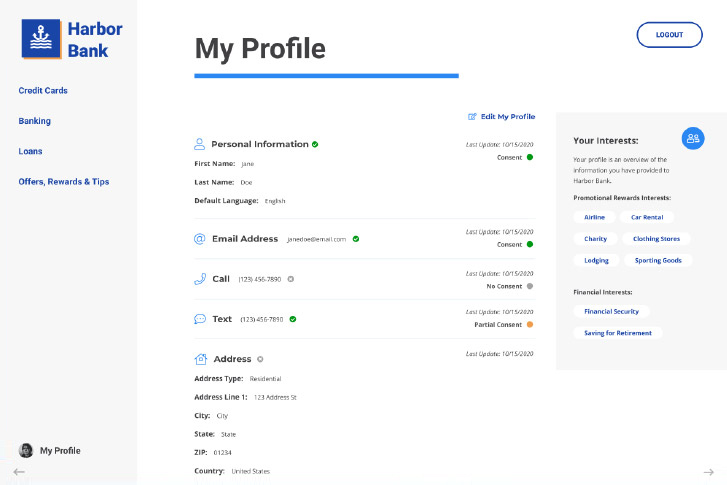

Allow Customers to Share Their Interests

Banks and financial institutions offer many services such as checking, savings, investments, insurance, and home and auto loans. Give your customers the ability to freely share which of your services are of interest and their preferred communication channel via preference centers, email opt-down pages, and service centers.

Learn Financial Services Best Practices. Book a 30-minute Consultation.

BOOK NOW

CHANGE

Financial Services Is Changing

Financial services customers expect to be able to complete any financial transaction, over their preferred digital channel, 24 hours a day. This expectation is driven by the emergence of new disruptive online banking that challenges traditional brick-and-mortar. Financial institutions must evolve to keep up.

Enable your institution to deliver seamless customer experiences, based on individual circumstances such as spending habits, insurance requirements, and risk tolerances to expand customer engagement.

Forrester: ROI of Zero Party Data - Building Customer Trust

WATCH WEBINAR

DATA

Data Integration

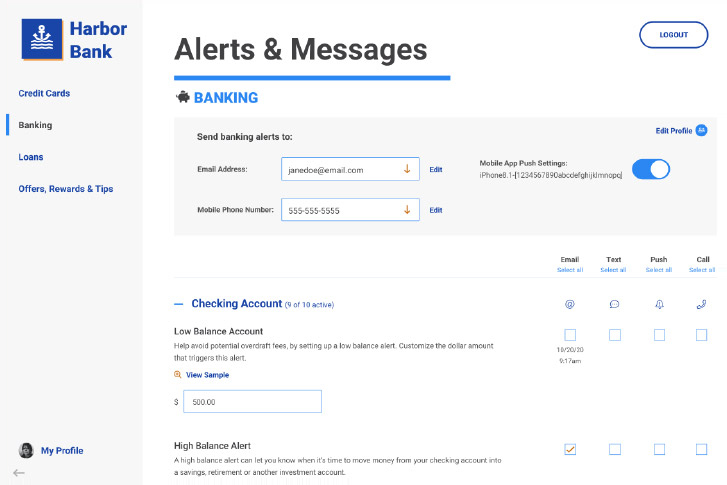

Collecting and utilizing customer consents & preferences requires that data to be shared across your organization via real-time or batch integration. Our advanced data integration platform offers pre-built connectors to most CRMs, ESPs, and MAPs, making it easy to connect with your existing tech stack while maintaining compliance with global financial and data privacy regulations.

CHANGE

Prepare for the Future of Financial Services

Our experts use decades of industry best-practices and advanced data management techniques to recommend solutions that work for your unique organization and customers. Consent and preference records are securely maintained, and customers can update their consent and preferences at granular level, with updates dynamically populated across the organization using near real-time APIs.

Build a better customer experience, increase financial services efficiency, and provide cost-effective service for your customers. Speak to one of our experts today.